How to Sell a Service Business

Do you have a service business you want to sell but don’t know where to start?

This guide will take you through the process step-by-step.

The service industry hosts a range of sectors from laundry & cleaning services to gardening & landscaping.

It is a lucrative sector with buyers keen to enter this wide-ranging market.

An exciting service within this industry is employment & recruitment, it saw a record year, being valued at £38.9 billion.

A similarly promising service is the estate & letting sector. It has a market value of £12 billion, and there are over 27000 of these businesses in the UK. So if you have one to sell, make sure you follow the tips in this guide to make sure yours stands out to buyers.

Read on for valuation advice, tips on how to prepare your business for sale, negotiation information, and how to finalise the deal.

Each business’s assets will differ according to the type of service you provide.

But for each sale, the starting point is the same. You must combine your business’s assets and its goodwill features to gain an exact valuation.

Let’s look at typical assets for a cleaning business:

The age and condition of your assets are important in a valuation, so be honest.

The goodwill of a business is more complicated to calculate than its physical assets, but it’s no less important in achieving an accurate valuation.

Using a landscaping business as an example, consider the following:

We understand that some owners have an emotional attachment to their business, and we know that this can make it difficult to provide an objective valuation.

Therefore, we recommend using a business broker to obtain a fair price.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of service businesses.

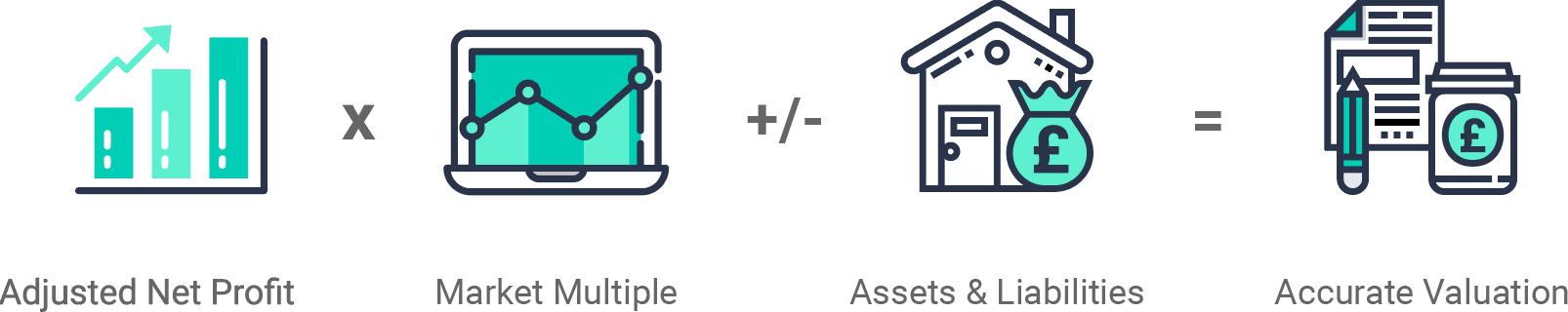

We look at each business independently for its valuation, but the basic formula remains the same:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

A good starting point in preparing your business for a sale is to have the necessary information and documents ready.

This will ensure you are prepared for questions prospective buyers will have. Being prepared will also make you look more confident and professional.

Also, ensure you fix any problems within your business to achieve the best possible price.

Let’s look at some important areas to focus on.

A top priority for any buyer is hygiene, and for some service businesses such as estate agents, is it important how your staff present themselves.

Fortunately, it is relatively easy and affordable to improve in this area.

Some buyers are only interested in businesses which can be operated in a hands-off manner, so having a clear operation and management structure in place makes your business more attractive to a wider audience.

This is especially important to address in cases where owners are heavily involved with the everyday running of their business.

To achieve this, you might consider asking your current managers and/or team leaders to take on more responsibilities on a day-to-day basis.

If you’re selling property as part of your company, ensure you undertake any maintenance and repair work.

This is an efficient way to boost the value of your business. But remember, don’t carry out a complete refurbishment or buy new expensive equipment just before your sale.

The buyer may want to refurbish the unit to suit themselves. Equally, you won’t regain the cost of new equipment in your sale price.

Prospective buyers will request at least three years of financial statements. So, have these prepared and ready to show. You can ask your accountant to help you with this.

This enables a potential buyer to have an overview of your business’s financial health and stability.

The financial documents you will need are as follows:

Make sure you’re honest, as when the buyer undertakes due diligence, any falsehoods within the business’s finances will be discovered.

Other important documents to gather include:

After successful enquiries and viewings, an interested buyer will progress into the negotiation stage.

If you have your documents prepared in advance, negotiations will be more efficient. Here you will decide what’s included or excluded from the sale price.

Remember:

This is a two-way process. Naturally, the buyer will be enquiring about all aspects of the business, but you should also be assessing their potential to run a company successfully.

Next, you will move on to drawing up a ‘Heads of Terms’ or ‘Letters of Intent’ document. This will include the final sale price, the sale’s terms, and a thorough itinerary of everything included in the sale. Once these items are agreed, both parties will sign the document.

For all intents and purposes, your negotiations are final. However, it is not yet legally binding.

There are a couple of options for payment.

You may want to offer owner or seller financing. This is where the buyer pays in instalments, resulting in a larger overall sale price. Alternatively, your buyer may prefer, and be able to pay in a lump sum.

It is important to seek quality legal advice from a solicitor as you may be at risk of a buyer default.

If you’re unsure about which solicitor to use, we can help by matching you with one of our trusted partners.

Using an Intelligent trusted partner, you’ll save time and money. Sellers complete on average 4 weeks earlier than the industry standard and our negotiated savings are passed on in full.

The final step before the sale is finalised is for the buyer’s purchasing team to carry out necessary due diligence checks.

Due diligence involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition. For more on this read our in-depth guide.

This is it, the final stage of selling your business!

If due diligence checks are cleared it will allow the buyer to commit to a final, legally-binding ‘Purchase of Business Agreement’. The terms of which will be similar to the ‘Heads of Terms’ or ‘Letters of Intent’ document from the negotiation stage.

This is important…

If any problems are uncovered during due diligence, it may lead to renegotiation of the terms of sale or the price.

In a worst-case scenario, the buyer may drop out of the sale completely.

Therefore, it’s essential to be truthful throughout the entire selling process.

Ensure you obtain any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities.

Once these documents are finalised and the money is transferred, you will have officially sold your business.

Congratulations!

One final thing…

Wondering about the handover?

You can choose to have a transitional or an immediate handover.

A transitional handover allows for a gradual exchange of ownership, with an overlap in the management between you and the buyer. It is up to you how long this period lasts. It is usually a few weeks or months.

Or, you may opt for an immediate handover. This means there is a sudden shift in ownership and management.

From this point, the new owner is responsible for the running of the business and the seller has no more involvement.

We recommend a transitional handover where possible.

It is more attractive to buyers as they get insight into the current day-to-day running of the business.

How to Handle Customer Complaints

A Guide to Completing & Filing Your Self Assessment Tax Return

There it is, a guide on how to sell a service business.

It may seem like hard work, but with a little preparation and planning, you can achieve the best possible price for your business.

By selling with Intelligent, we will take away the stress of selling so that you can focus on your business instead.

Our dedicated expert team will work hard to fully understand your service business and what makes it unique, giving you peace of mind.

Why not get a free, instant valuation of your business via the tool below?

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.