Get Free Confidential Expert Advice

0800 612 7718Selling Your Company

Our director led team will take the time to fully understand your business, ensuring a bespoke and thorough plan is deployed to maximise return

As part of our approach, we will match shareholder aspirations to the best possible exit strategy. The reason for sale may vary, but understanding the shareholder capital plan will determine the perfect route to exit. With our board of trusted partners, including wealth management and tax advisors, understanding exit aspirations will help tailor our plan

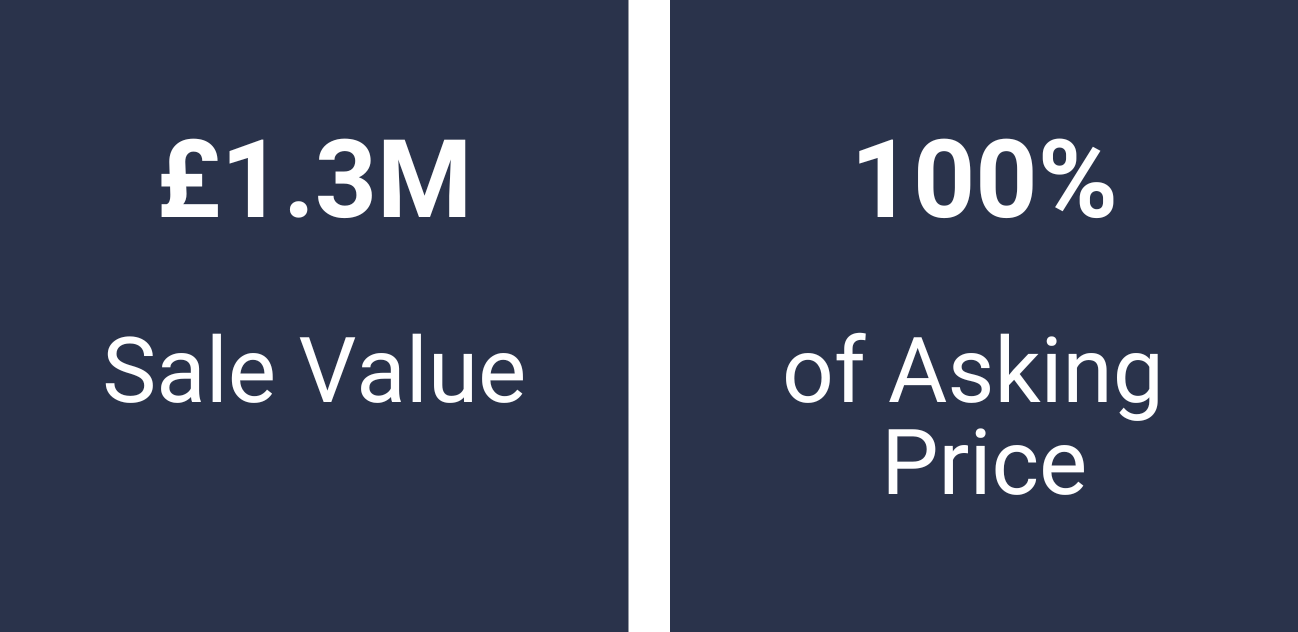

Our proven approach, paired with our dedicated expert team, providing confidential support 24/7, delivers a frictionless transaction across all types of business sale, from private equity investments to trade sales and employee or management buyouts

The UK's #1 for Company Sales

Meet the Team

Who will sell your company? When you sell your business with Intelligent Corporate the transaction is director led, and supported by our team of business sales specialists, ensuring you achieve maximum exit value

Smart Buyer Targeting

Profile > Prospect > Present

1. Profile

These transactions are often once in a lifetime. It’s the opportunity to crystalise significant input and maximise reward. Our team will engage with the business and fully immerse themselves within it, ensuring all future buyer interactions are accurate, effective and impactful. Our research team will build an extensive Intelligent Buyer Profile to identify the ideal purchaser. This technology-led approach uses market insight, search analysis and sold business data to determine who to target

This process will result in a bespoke Information Memorandum (IM), tailored specifically to your business, alongside an anonymised one-page teaser to drive interest. Confidentiality is often a requirement of a Corporate Sale, so a robust Non-Disclosure Agreement (NDA) process is always strictly adhered to

![]()

![]()

2. Prospect

The Intelligent Buyer Profile is then matched against our exclusive internal database of over 125,000+ contacts. This includes a cohort of over 20,000 trusted private equity partners, high net worth individuals, trade buyers and other investor partners

A targeted and external approach list is also identified. Whilst it is likely that your target buyer is already known to us, our research team will also use the Intelligent Buyer Profile to proactively search within the wider market

The business for sale is published, with a premium feature, on the UK’s leading business listing websites and select specialists, relevant to the business sector in question, promoting an unrivalled marketing reach

3. Present

Our team will then take a rigorous approach to contact pre-agreed and approved prospects. Effective and high-impact interactions are critical. When handling inbound enquiries, the legitimate nature of potential buyers is tested to ensure interested parties have the desire and the means to transact

Our conversations are always treated with the utmost confidence and where the need for a fully confidential sale arises, our process is second to none. Many sellers seeking acquisition or investment require discretion in order to protect employees, customers and suppliers throughout the process. Following the completion of an NDA, any potential buyers will be presented with a bespoke, in-depth, high-quality IM exploring the opportunity at hand in detail

![]()

Our expert team are incentivised to achieve maximum value. We facilitate the due diligence process and throughout, promote competitive bidding. Our team uses all opportunities to create the landscape between interested parties, to result in increased offers, at a fast pace

On maximum offer acceptance, Intelligent Corporate will lead the transaction right through to completion, alongside our trusted partner network of legal professionals

With our support, 1,000’s of business sellers have achieved a successful exit