How to Sell a Retail & Shop Business

Do you have a shop & retail business you want to sell, but don’t know how?

We can help guide you through the whole process from start to finish, and we are always here for any queries you may have.

UK retail is a promising sector which has achieved sales of £394 billion this year.

It is responsible for 1/3 of consumer spending, 2.9 million UK jobs, and amounts to 5% of total GDP.

Whether you are looking to sell a clothing, footwear & accessories shop, or a florist business, it is an exciting time for buyers looking to enter this lucrative industry.

There are 306,655 retail outlets in the UK, from wine merchants to card & gift shops. With thousands up for sale right now, it is important to follow our top tips in this guide to ensure your business stands out to attract the most interest.

Read on for a walk through the complete sales process.

Including valuation advice, how to prepare your business for a sale, negotiation tips, and finalising the deal.

To calculate an accurate valuation of a business, you must combine the business’ assets and, equally as important, its goodwill attributes.

Your business’ assets will differ according to the type of retail sector you are in.

Let’s look at typical assets for a clothing, footwear & accessories shop:

The higher the quality of the assets, the less a potential buyer needs to worry about replacing any items soon, therefore providing better value for money.

Because of this, it may be tempting to exaggerate the condition and age of your assets, however, it is best to be 100% honest for an accurate valuation.

Although determining the goodwill value of a business is more difficult, it’s just as important.

When estimating your shop & retail business’ goodwill value, it’s important to consider the following (using an off-license as an example):

We understand of course there can be an emotional attachment to your business. This can make it difficult to remove bias from your valuation.

Because of this, we recommend seeking advice from a business broker for an accurate price.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of shop & retail businesses.

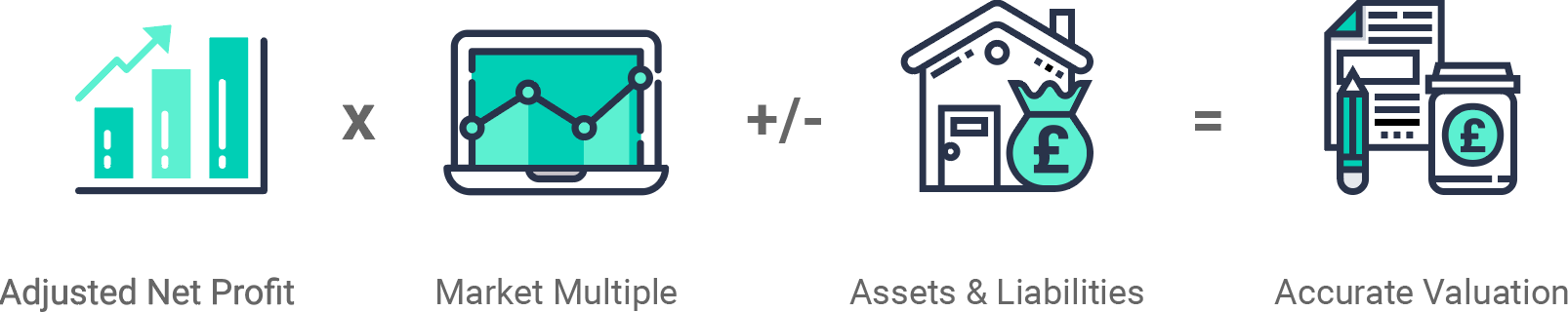

We look at each business on an individual basis, but we use the same basic formula, take a look below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

Ensure you have all necessary documents and information prepared in advance. This means you are ready for any questions interested buyers will likely have.

It will result in a more efficient and smoother selling process, as well as making you appear more professional and confident.

But that’s not all.

By fixing any problems with your business you can be assured that you will receive the best possible price.

Below we have highlighted key areas to focus on when preparing your shop & retail business for sale.

An efficient way to boost the price of your shop & retail business is to ensure any immediate repair and maintenance has been undertaken.

Fixing these issues prior to the sale makes your business an attractive option to buyers as it will save them a considerable amount of hassle if there’s work that needs to be done.

There’s something important to remember.

Although repairs and maintenance are essential - don’t carry out a refurbishment or invest in brand new expensive equipment just before your sale.

The buyer may want to change the appearance of the unit to suit them.

This is especially important in fashion establishments where aesthetics are crucial. Similarly, you won’t regain the cost of pricey new equipment in your sale price.

Hygiene is a top priority for potential buyers. So, it is crucial to ensure the highest standards to maintain buyer interest.

This is especially important in any type of food shop.

Conveniently, this is a relatively simple and affordable action in boosting your business’s value.

It is recommended to have at least three years of financial statements prepared, ready to show interested parties. This usually happens at the enquiry stage.

These figures will enable a buyer to have an overview of your business’s financial health and stability, helping them to decide if it is a suitable choice.

The financial documents you will need are as follows:

The buyer will undertake due diligence which will highlight any inaccuracies within your business’s finances, so make sure you’re completely honest from the start.

Other important documents to gather include:

When you’re preparing to sell your business, it is crucial to have an organised business structure.

This is especially important in situations where owners are heavily involved with the day-to-day management of their business.

Having a clear operations structure makes a business more attractive to buyers who may only be interested in businesses that can be operated in a hands-off manner.

Are you a hands-on business owner? Why not start delegating more responsibilities to your current managers and/or team leaders.

After this careful preparation, it’s time for negotiations.

After fruitful enquiries and viewings (click here for our guide on how to manage interested parties), if you have an interested buyer, you’re ready to move into the negotiation stage.

Now’s the time to discuss what is included in the sale. As you’ll have your documents prepared in advance, you’ll be able to negotiate more efficiently. Naturally, the buyer will be inquisitive but remember, this isn’t a one-way process.

You should also be assessing their potential and capacity to run a retail business successfully. Both parties should agree on terms which will be written down and signed by both parties on ‘Heads of Terms’ or ‘Letters of Intent’ documents.

This document will include the final sale price, the sale’s terms, and a thorough itinerary of everything included in the price. At this point, the sale is essentially finalised. But note, the sale is not legally binding at this point.

You must then decide on payment terms. There is more than one option. The buyer may be able to pay in a lump sum, but you could also offer a payment plan, with a larger total sale price. This is known as owner or seller financing.

It’s crucial here that you enquire about specific protective legal advice as you could be at risk of a buyer default. This is one of the reasons it’s important to use a good solicitor.

We can help with that. Using an Intelligent Trusted Partner, you’ll save time and money. Sellers complete on average 4 weeks earlier than the industry standard and our negotiated savings are passed on in full.

However, seller financing is often a practical solution for both parties.

Then it’s time for due diligence checks. This is undertaken by the buyer and their team of professionals.

We have an in-depth guide on this, but it essentially involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition.

Hooray! You’re here, you have arrived at the final stage of selling your business.

After successful due diligence checks, this will allow the buyer to commit to a final, legally-binding ‘Purchase of Business Agreement’. This document will resemble the ‘Heads of Terms’ or ‘Letters of Intent’ from the negotiation stage.

However, if any falsehoods are uncovered during due diligence, this would usually lead to renegotiation of the price and/or terms of sale. In the worst-case scenario, the buyer may drop out of the deal completely.

This is why it’s crucial that you are completely honest throughout the entire selling process.

There’s something else.

You will need to obtain any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities. After you have finalised these documents and the money is transferred, this means you will have officially sold your business.

Congratulations!

Just one more thing. How does the handover work?

It can be immediate or transitional.

An immediate handover is when there is an immediate shift in ownership and management. Meaning the running of the business will now be up to the new owner.

On the other hand, there is a transitional handover. This allows for a smoother exchange of ownership.

The terms of this handover are up to you and the buyer. Usually, the seller will stay on for a transitional period. This tends to be for a couple of weeks or months.

We recommend conducting a transitional handover wherever possible. This gives insight into the day-to-day running of the business. It is more attractive to buyers and is more likely to result in successful new ownership.

There you have it, the ultimate guide to selling a shop & retail business.

It may seem like a tough process, but with a little preparation and planning, you will achieve the best possible sale price.

Selling with Intelligent removes the stress so that you can focus on your business instead.

We have a dedicated expert team who will work hard to fully understand your shop & retail business and what makes it unique, giving you peace of mind.

Get a quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.