How to Sell a Financial & Professional Business

Thinking about selling your financial & professional business, but unsure of the process? We can help.

This guide includes valuation advice, tips to prepare your business for a sale, negotiation information, and finalising the deal.

TheCityUK reports that the UK has one of the largest and most developed markets for this industry. This is unsurprising as it hosts a wealth of sectors such as accountancy & bookkeeping firms, consulting & management firms, and insurance & mortgage companies.

With financial & professional services making up 25 % of UK businesses and a combined turnover of £399 billion, there are plenty of interested buyers wanting to enter this thriving market.

Read on for a walk through the complete sales process.

To calculate an accurate valuation of a business, you must combine the business’ assets and as equally as important, its goodwill attributes.

Your business’ assets will differ according to the type of professional service your company provides.

Let’s look at typical assets for an accountancy & bookkeeping firm:

Higher quality assets mean the buyer does not need to worry about replacing any items soon. This makes it more attractive as it provides better value for money.

Determining the goodwill value of a business is more difficult, but it’s just as important.

When estimating your financial & professional business’ goodwill value, consider the following (let’s use a mortgage company as an example):

We know that sometimes there is an emotional attachment to your business. This can make it difficult to remove bias from your valuation.

Because of this, we recommend seeking advice from a business broker for an objective and accurate price.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of financial & professional services.

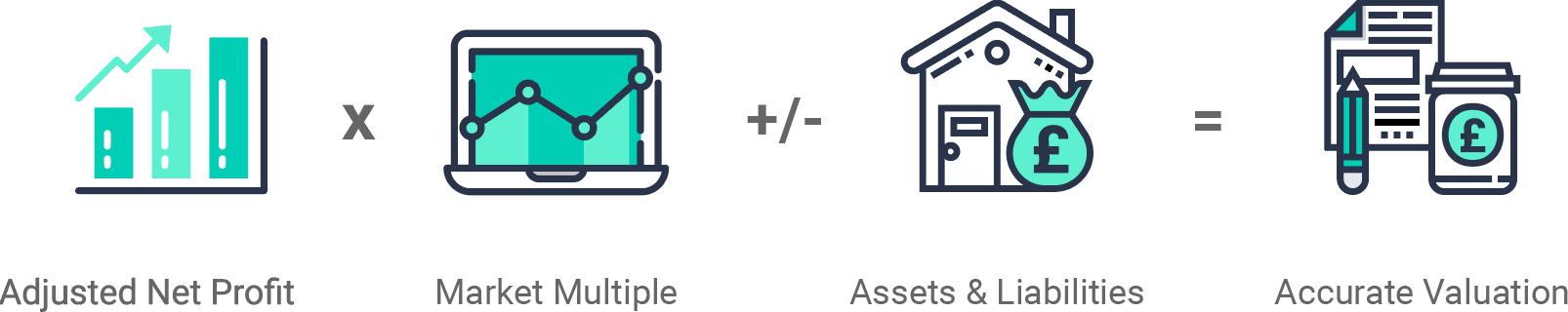

We look at each business on an individual basis, but we use the same basic formula, take a look below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

Ensure you have all necessary documents and information prepared in advance. So, you’ll be ready for any questions when you are approached by prospective buyers. Not only that, but it will result in a more efficient and smoother selling process too.

Also…

By fixing any problems with your business you can be assured that you will receive the best possible price.

Below we have highlighted key areas to focus on when preparing your financial & professional business for sale.

A relatively affordable and easy way to boost the price of your business is to ensure any immediate repairs and maintenance jobs have been undertaken.

Fixing any problems makes your business an attractive option to buyers as it will save them a considerable amount of hassle after the sale.

But remember:

Although we recommend fixing any immediate issues, there is no need to carry out a refurbishment or invest in brand new expensive equipment just before your sale.

It may result in a waste of time and money as the buyer may want to change the appearance of the unit to suit them.

Similarly, you won’t regain the cost of pricey new equipment in your sale price.

Hygiene is always high on the priority list for buyers, so, it is crucial to ensure the highest standards to maintain interest. Conveniently, this is a simple action to boost your business’s value.

At the enquiry stage, interested parties will expect to see at least three years of financial statements. So, have these ready in advance, it will make you appear prepared and confident.

These statements will enable a buyer to have an overview of your business’s financial health and stability, helping them to decide if it is a suitable choice.

The financial documents you will need are as follows:

The buyer will undertake due diligence which will show any falsehoods within your business’s finances, so make sure you’re 100% honest throughout the process. Other important documents to gather include:

When you’re preparing to sell your business, it is crucial to have an organised management structure in place. This is important in cases where owners are heavily involved with the day-to-day management of their business.

Having a clear structure makes a business more attractive to a wider audience as some buyers may only be interested in businesses that can be operated from a distance.

Are you a hands-on business owner? Why not start delegating more responsibilities to your current managers and/or team leaders.

After enquiries and viewings (click here for a guide on how to manage queries), you’re ready to move into the negotiation stage with your interested buyer.

Now’s the time to discuss what is included in the sale. Having your documents prepared in advance means you’ll be able to negotiate more efficiently.

At this stage the buyer will be understandably inquisitive but remember, this isn’t a one-way process. You should also be assessing their potential and capacity to run a financial & professional business successfully.

Next, you will move on to drawing up a ‘Heads of Terms’ or ‘Letters of Intent’ document. This will include the final sale price, the sale’s terms, and a thorough itinerary of everything included in the sale. Once these items are agreed, both parties will sign the document.

Through doing this, the sale is essentially finalised. But note, it is not legally binding at this point.

When it comes to payment, there is more than one option.

The buyer may be able to pay in a lump sum, but you could also offer a payment plan, known as owner or seller financing, often resulting in a larger total sale price.

But make sure you enquire about specific protective legal advice here as you could be at risk of a buyer default.

This is one of the reasons it’s important to use a good solicitor. We can help with that.

Using an Intelligent trusted partner, you’ll also save time and money. Sellers complete on average 4 weeks earlier than the industry standard and our negotiated savings are passed on in full.

After the payment procedure has been agreed, the buyer and their team will then undertake due diligence checks.

We have an in-depth guide on this, but it essentially involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition.

Hooray! You have arrived at the final stage of selling your business.

After successful due diligence checks, the buyer will be in a position to commit to a final, legally-binding ‘Purchase of Business Agreement’ (this will be similar to the ‘Heads of Terms’ or ‘Letters of Intent’ from the negotiation stage).

However, if any issues arise during due diligence, the terms of the sale or price would most likely need to be renegotiated.

In the worst-case scenario, the buyer may drop out of the deal completely.

This is why you must be completely honest throughout the entire selling process.

Something else to remember:

You will need to obtain any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities.

Once the money is transferred, you will have officially sold your business.

Congratulations!

Just one more thing…

You need to know about the handover. There are two types, immediate or transitional.

An immediate handover is when there is an immediate shift in ownership and management. From this point on, the seller has nothing more to do with the business.

Or you may opt for a transitional handover, allowing for a smoother exchange of ownership.

The terms of this handover are up to you and the buyer. Usually, the seller will stay on for a transitional period (a couple of weeks or months) and gradually pass on ownership to the buyer.

We recommend transitional handovers. They give great insight into the day-to-day running of the business to the new owner. They are also more likely to result in successful new ownership, making your business more attractive.

There you have it, the ultimate guide to selling a financial & professional business.

It may seem like a tough process, but with a little preparation and planning, you will achieve the best possible sale price.

Selling with Intelligent removes the stress so that you can focus on your business instead.

We have a dedicated expert team who will work hard to fully understand your business and what makes it unique, giving you peace of mind.

Why not get a free, instant valuation of your business via the tool below?

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.