How to Sell a Coaching, Education & Training Business

Are you the owner of a coaching, education & training business? Would you like to sell, but you’re not sure where to begin?

Selling can be a daunting process, so we’ve put together a step-by-step guide to run you through the key steps.

The education and training industry is worth £3 billion, employing over 8,000 people across the country.

In fact, in a recent survey, two out of three businesses advised that they regularly invest in external training and education for their staff.

And that’s not all.

According to the Tutors Association, there are 10,000 private tutors across the UK, with 35% or parents suggesting they’ve hired a tutor for their child in the pats.

This means - whether you’re a business & life coach, a trainer for trade & workplace or even a private tutor - there are buyers out there keen to snap up a business like yours.

This guide will take you through the whole process from valuation advice, how to prepare your business for a sale, negotiation tips, to finalising the deal.

Calculating the value of a business involves combining its goodwill attributes and its assets.

A business’ assets will vary depending on what type of coaching, education & training business is being run.

Using a private tuition business as an example, let’s take a look at its assets:

High-quality assets are often very attractive to a potential buyer, as they won’t have to be concerned about sourcing new resources anytime soon.

The goodwill value of a business can be more difficult to calculate – but is still a key element of the business valuation process.

Here’s what to consider when valuation your coaching, education & training business’ goodwill attributes:

Whilst it is possible to try and value a business yourself, many business owners struggle to do so as they have an emotional attachment to their company. That’s why we would always recommend using a professional business broker when valuing your business.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of coaching, education & training businesses.

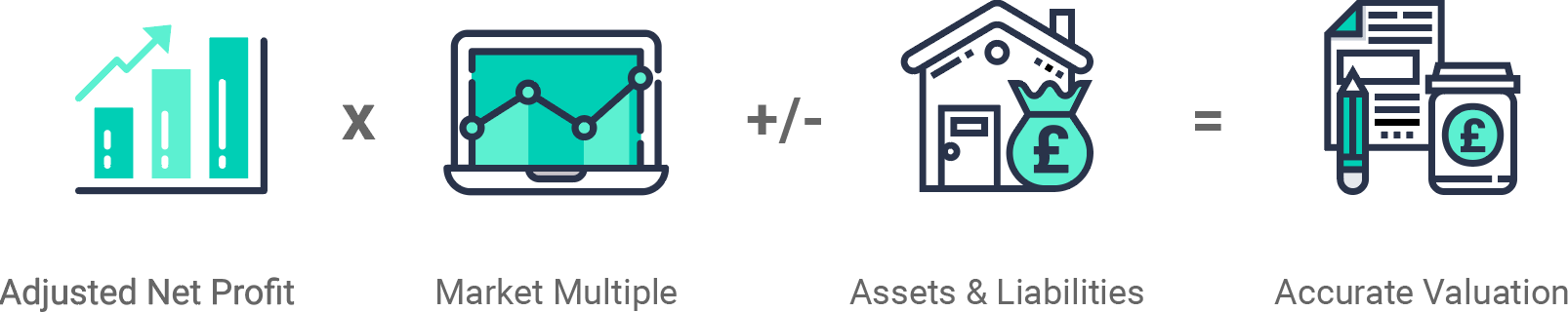

We use a tailored approach, taking the time to understand you, your business and your goals, but we use the same basic formula as shown below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

The first step to selling your business is to ensure you’re fully prepared. It’s important to think ahead, gathering all of the necessary documentation and information in advance. This will put you in the best position to handle questions from potential buyers.

What else should you do?

Making your business as attractive as possible can be the difference between a potential buyer enquiring about your business, or dismissing it for another opportunity.

Here are some key elements you should start thinking about whilst preparing to sell your coaching, education & training business.

An efficient way to boost the price of your business is to ensure any immediate repair and maintenance has been undertaken.

Fixing these issues before the sale makes your business an attractive option to buyers as it will save them a considerable amount of hassle if there’s work that needs to be done.

There’s something important to remember.

Although repairs and maintenance are essential - don’t carry out a refurbishment or invest in brand new expensive equipment just before your sale.

The buyer may want to change the appearance of the unit to suit them.

It's also important to ensure your business is meeting current recommendations in terms of hygiene and cleanliness - showing that you're up to date with current regulations.

Different buyers are looking for different things. Some will be looking for a hands-on business that they can be involved in. Others, however, may want to operate it from a distance.

This means it is crucial to have a clear management structure when you’re preparing to sell your business.

If you’re both the business owner and manager, you might want to think about delegating more responsibilities to your current managers and/or team leaders.

One of the first things an interested party will want to see is your accounts. That’s why we recommend you have at least three years of financial statements prepared in advance.

The financial documents you will need:

These documents should be as honest and as accurate as possible. Most buyers will undertake due diligence as part of the buying process, which will highlight any discrepancies in your financial history.

Here are some other documents you should collate whilst preparing to sell:

Buyers will usually ask to see this during their initial enquiry. Read more about how to handle buyer enquiries and viewings.

Once you’ve found a potential buyer for your business, its time to negotiate. Having the documents listed above will play a big part in ensuring you’re prepared for this stage.

This process will likely involve a lot of back and forth, as you work to agree on a sale price that works for you and the potential new owner. At this stage, you should also be agreeing exactly what assets, fixtures and fittings are going to be included.

Once you’ve negotiated terms that you’re both happy with, they will be written up in a document called the ‘Heads of Terms’ or ‘Letters of Intent’. Both yourself and your buyer will sign this.

Whilst your sale has now been agreed, it isn’t legally binding – yet.

Wondering what comes next?

Well, now it’s time to decide on a payment plan. If your buyer isn’t able to pay you the full amount upfront, you could consider offering owner financing.

The most important thing at this stage is to secure specific protective legal advice. This will help to reduce the risk of a buyer default, making it imperative that you use a good solicitor.

We can help with that.

Using an Intelligent trusted partner will save you time and money. We’ve found that our sellers complete on average 4 weeks earlier than the industry standard.

Your buyer and their solicitor will now begin the due diligence process.

We’ve put together an in-depth guide all about due diligence, but in a nutshell, it involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition.

Be wary, if any falsehoods are revealed here you may find yourself having to renegotiate. In a worst-case scenario, your buyer may drop out of the deal.

Hence our recommendation that you’re honest with potential buyers from the get-go.

Whilst you wait, we’d recommend taking the time to gather any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities.

Congratulations - you’re at the final stage of selling your business!

Once your buyer has completed their due diligence, the time has come for them to sign a final, legally-binding ‘Purchase of Business Agreement’.

Once these documents are finalised and the money is transferred, you have officially sold your business.

So that’s it… right? Almost.

Depending on your buyer, you might want to consider the type of handover you’d like to offer.

There are two types of business handover; immediate or transitional.

An immediate handover is when you exit the business as soon as it has been purchased.

A transitional handover involves a more gradual the exchange.

You can decide what works best for you with your purchaser, usually, the seller will stay on for a transitional period of a couple of weeks or months.

We recommend this type of handover where possible. It is more likely to result in successful new ownership and is, therefore, more attractive to buyers.

Capital Gains Tax, Why Now is the Time to Sell

Case Study: Coaching, Education & Training

FREE Webinar: How to Sell your Business

And that’s it – our ultimate guide on how to sell your coaching, education & training business.

It can be a lengthy process, but a little preparation goes a long way and will help you to achieve the best possible price for your business.

Using Intelligent removes the stress of selling, meaning you can continue to focus on the day to day running of your business instead.

We have a dedicated expert team who will work hard to fully understand your business and what makes it unique, giving you peace of mind.

Why not get a free, instant valuation of your business via the tool below?

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.