How to Sell a Home Based Business

Working from home has become an increasingly attractive prospect in recent times. With over 2.7 million businesses based at home in the UK, more and more people are able to turn a profit without even having to leave the house.

But what happens when you’re ready to move on from your home based business? Is it possible to sell a business that is run from home? Absolutely.

We’ve put together a step-by-step guide to talk you through how to sell your home based business, including how to conduct a valuation, preparing your business for sale and completing with your solicitor.

To value your home based business you must combine your business’ assets and its goodwill attributes.

You might be wondering; what assets can a home based business have? Well, just because you’re not operating from a fixed premises doesn’t mean you’re without assets. These can include:

The second element is the goodwill value of your business. This can be quite difficult to assign a value to, but it is an essential part of a valuation. Here are some aspects that you can include:

It’s more than possible to value your business yourself, but sometimes you can get in your own way. To calculate an accurate valuation, you must be completely free from bias. As a business owner, it can be difficult to emotionally detach yourself.

That’s why we would always recommend enlisting the help of a professional business broker to achieve an accurate sale price.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of health and beauty businesses.

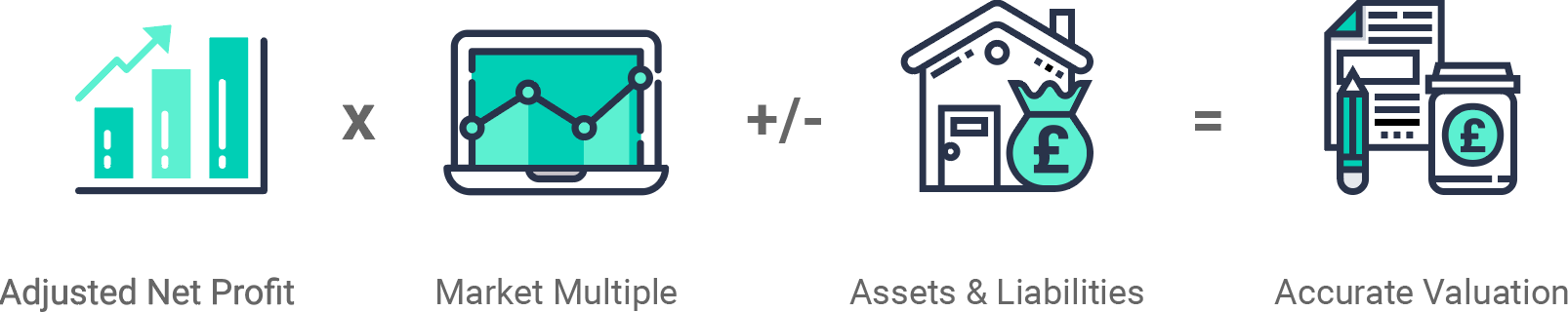

We use a tailored approach depending on the business’s characteristics but using the same basic formula as shown below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

There are many things you can do to begin preparing your home based business for sale. First of all, it’s important to make sure you have all of the correct information ready in advance. This will also put you in the best position to answer any questions an interested buyer may have.

That’s not all…

By fixing any problems with your business you can be assured that you will receive the best possible price.

Below we have highlighted key actions you should take when preparing your home based business for sale.

Even though you don’t have a physical property to maintain and repair, there’s still plenty of tidying up you can do to make your business as attractive as possible.

Make sure your business is as up to date as possible, with modern branding and a functional online presence. If you don’t already, set up some social media pages and be sure to post regularly to interact with your audience.

This will show any potential buyers that your up to date with current trends, plus it will be one less job for them to do once they take over.

Before you sell your business, you should ensure you own all of its intellectual property. You can start by trademarking the business’ name and logo.

Ensuring that the business’ trademark, designs, software and domain names belong to you exclusively will make your business more attractive to any potential buyers. Plus, checking this now will ensure there are no hiccups later on down the line.

We’d always recommend that you have at least three years of financial statements prepared to show interested parties. This is one of the first things a potential buyer will ask to see when they enquire.

Here are some of the financial documents you will need:

Some other important documents to gather include:

Many home based business' are operated solely by the business owner. This makes it even more important to ensure all of your day to day operations are recorded in an easy to follow way. This means that when a new owner takes over the business, they can do so without a hitch.

If you do employ a team of staff, start to think about your management structure. Some buyers will be keen to get involved with the day-to-day operations, but others will want to adopt a more hands-off approach.

Where possible, try to delegate some of your responsibilities to other members of your team. This will make your business more attractive to buyers looking to be less involved in the business they buy.

Once you’ve found someone interested in purchasing your business, it’s time to start the negotiation.

This is where you will agree upon an acceptable sale price, as well as everything that is going to be included in the sale. This will be a bit of a back and forth process, but stick with it – it’s unlikely that an interested party will come in with their best and final offer in the first instance.

Having all of your documents prepared in advance will only enable you to negotiate more effectively, so be sure you don’t skip any of the preparatory steps above.

Once agreed, the terms of your sale will be compiled into what is known as the ‘Heads of Terms’ or ‘Letters of Intent document’.

Now your sale is agreed in principle, but there are a few more steps before it becomes legally binding.

A crucial one is to agree upon a payment option. Ideally, your buyer will be able to pay the full purchase price in one lump sum. But what happens if they’re not able to do this?

Well, if these instances you could consider offering something called owner or seller financing. This is essentially a payment plan, where your buyer will make instalments until they’ve given you the full amount.

This is often an attractive option for buyers but does bring with it some risks. This is why you should always instruct a trusted solicitor to guide you through the process.

When you sell with Intelligent, we will refer you to our board of Trusted Partners. This is made up of a number of fantastic solicitors, who will save you both time and money. In fact, sellers who follow our recommendations complete up to four weeks faster than the industry average.

You’re probably wondering what comes next?

Well, now your buyer and their legal team will conduct what is known as ‘due diligence’.

You can read about this in our in-depth guide, but it essentially involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition.

You’ve made it, you’ve reached the final stage of selling your business!

Once your buyers have completed their due diligence checks, they will sign what is known as a ‘Purchase of Business Agreement’.

However, be conscious that any inconsistencies that are uncovered during due diligence will likely lead to renegotiation of the price, or in a worst-case scenario the buyer may drop out of the deal completely.

That’s why it is absolutely vital that you are completely honest throughout the entire selling process, from start to finish.

Once these documents are finalised and the money is transferred, you will have officially sold your business.

One last thing, have you thought about a handover period?

There are two types of handover: immediate and transitional. An immediate handover is a sudden shift in ownership and management. This means the day to day running of the business will become the responsibility of the new owner as soon as the business changes hands.

Alternatively, you may decide to offer what is known as a transitional handover. This allows for a smoother exchange of ownership, where you would stay on board with the business for a short time to help your buyer become accustomed to their new business.

Where possible, we’d always recommend being open to a transitional handover – as it is often a more attractive proposition to buyers.

There it is, your ultimate guide to selling a home based business.

It may seem like hard work, but with a little preparation and planning, you can achieve the best possible price for your business.

By selling with Intelligent, we will take away the stress of selling so that you can focus on your business instead.

Our dedicated expert team will work hard to fully understand your business and what makes it unique, giving you peace of mind.

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.