How to Sell an Engineering & Manufacturing Business

Do you have an engineering & manufacturing business which you want to put on the market? This guide will walk you through the selling process.

The engineering industry contributed nearly £500 billion to UK GDP last year.

This growing market is exciting for buyers. It has been forecasted that a quarter of a million skilled engineering entrants are needed annually to meet the demand for enterprises through the next four years.

With similarly impressive statistics is the UK manufacturing industry. Its annual output is worth £192 billion, and the UK is one of the top ten manufacturing nations.

These figures demonstrate the wealth of businesses in this sector, and with many up for sale right now, it’s the perfect time for buyers to get into this thriving market.

Whether you want to sell your food & drink manufacturing business or an engineering company - read on for a walkthrough on valuation advice, how to prepare your business for sale, negotiation tips, and finalising the deal.

In valuing your business, it is important to look at its physical assets and its goodwill attributes. Both must be assessed to gather an accurate valuation.

The assets will differ depending on the type of business you are selling.

Let’s look at typical assets in a food & drink manufacturing business:

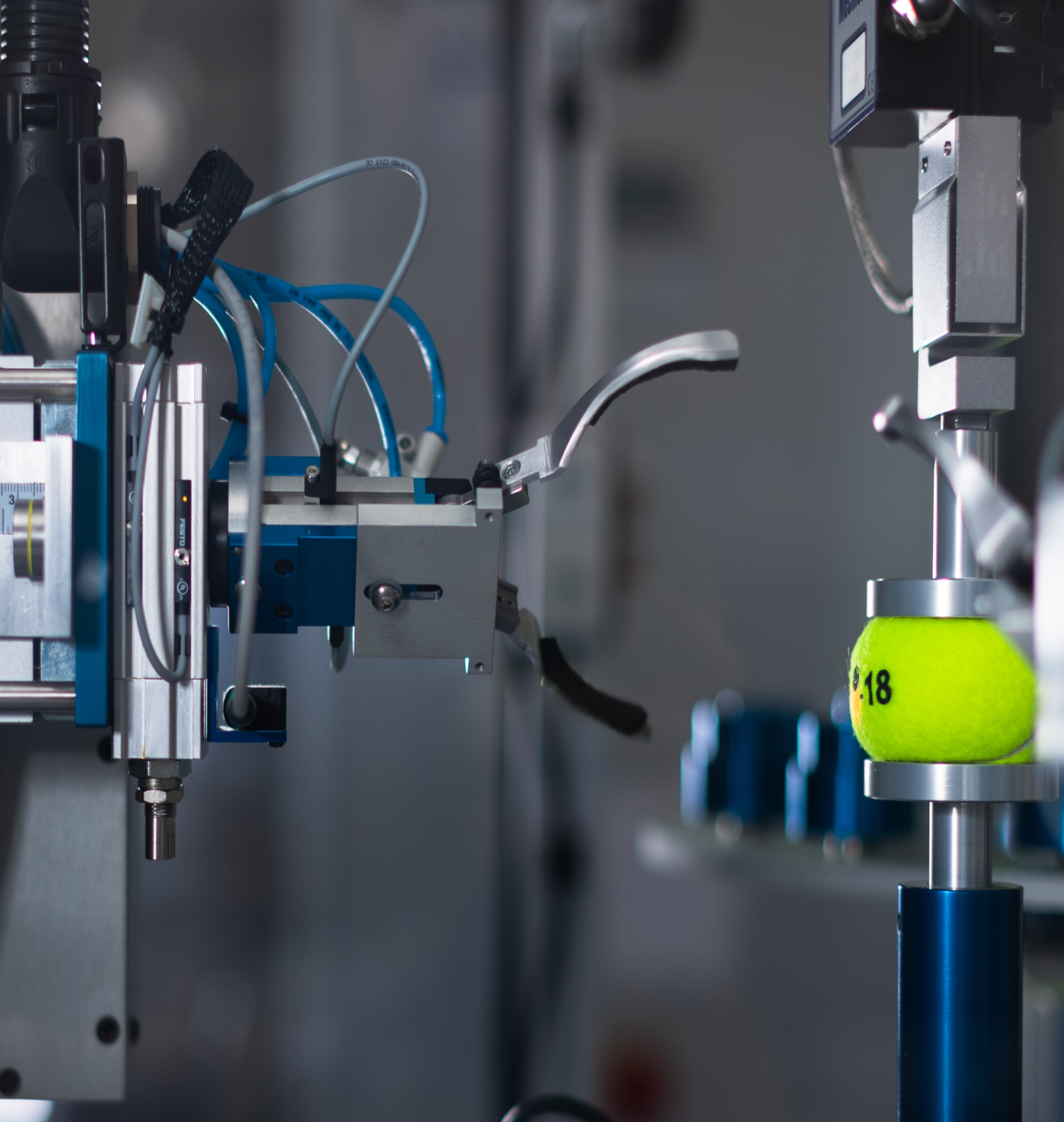

Machinery for production, preservation & packaging

The age and condition of your business’s assets are important to consider. Higher-quality assets provide better value for money and will save the buyer replacing items soon.

Calculating the goodwill value of a business is more difficult, but it is just as important as the physical assets in gathering an accurate valuation.

Using an engineering firm as an example, let’s look at some goodwill assets to look out for:

We know that it can often be difficult for owners to provide an accurate and objective valuation of their own business. Because of this, we highly recommend seeking advice from a professional business broker.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of engineering & manufacturing businesses.

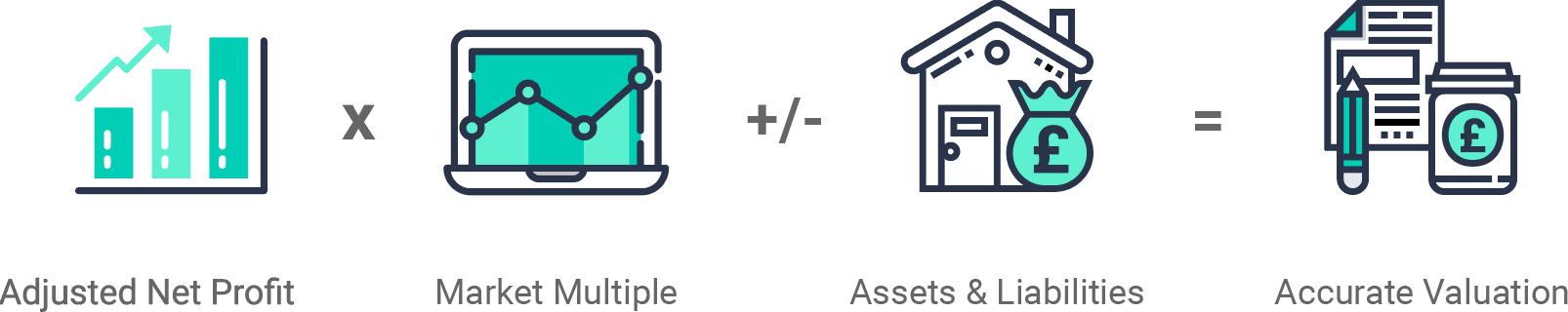

We look at each business on an individual basis and our team take time to understand your business’s characteristics, but as a starting point we use the same baseline formula as shown below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

When starting the process of selling your business, the first step to take is ensuring you have all the necessary documentation and information prepared. This means you will be in the best possible position when interested parties begin to enquire about your business. Being prepared will make you look like a professional, confident seller.

In the following, we highlight key areas you may want to focus on to ensure you will get the best possible price for your business.

This is important in any business sale, however, if your business involves food or beverages at any point on their journey to a sale (such as the production or packaging stages) – it’s crucial your site complies with top hygiene regulations to maintain buyer interest.

Fortunately, this is a relatively simple and affordable problem to fix.

Another effective way to boost the price of your business is to undertake maintenance jobs and repair work.

Doing this makes your business an attractive option, as doing this work before a sale saves the buyer hassle when they want to focus on the successful running of their new business in the future.

Having said that, don’t carry out a complete refurbishment as the buyer may want to change up the premises to suit them. Equally, don’t go and buy brand new expensive equipment just before your sale, it’s unlikely you will regain the cost of new equipment.

A crucial task when preparing your business for a sale is to ensure you have a clear, functional operations and management structure. We recommend this as often owners are heavily involved with the running of their business; however, new potential buyers may only be interested in businesses that can be run from a distance.

If you’re a hands-on owner, consider asking your current managers to take on more responsibilities in the running of the business.

If a buyer is interested, they will expect to see at least three years of financial statements. So, have these prepared and ready to show.

The key documents you need are:

Ensure you’re as honest as possible, as if falsehoods are revealed during due diligence, it may lead to the buyer withdrawing from the opportunity.

Other important documents to gather include:

This information on your business’s financial health will help a potential buyer to decide whether the business is the right choice for them.

After successful enquiries and viewings, if you have a buyer that wishes to progress, you will move on to the negotiations.

This process can sometimes take a while with lots of toing and froing, so we want to emphasise here again the importance of having your documents prepared so that you can have the most efficient negotiations possible.

You must now decide what’s included or excluded from the sale price.

Remember, this is a two-way process. Of course, the buyer will be asking lots of questions, but you should also be assessing their potential to run an engineering or manufacturing business.

Once the seller and buyer have agreed on terms, these will be formalised in a ‘Heads of Terms’ or ‘Letters of Intent’ document, this is to be signed by both parties.

The agreement will include the final sale price, the sale’s terms, and a thorough itinerary of everything included in the price.

By doing this the terms are formalised, however, they are not yet legally binding.

Now the terms of sale are agreed, what next?

It’s time to decide on a payment procedure.

You have two main options. The first is for the buyer to pay in a lump sum. Or depending on the buyer’s situation, you could offer a payment plan, with a larger total sale price (known as owner or seller financing).

Seller financing could work out as a viable option for both parties, however, there are risks involved.

Due to this, you must have a solicitor you can trust for quality advice as you may be at risk of a buyer default.

If you’re unsure of where to turn for a good solicitor, we can help by matching you with one of our trusted partners.

Using an Intelligent trusted partner, you’ll save time and money. This is a popular option for sellers, as they complete on average 4 weeks earlier than the industry standard and our negotiated savings are passed on in full.

The last stage in negotiations:

The buyer and their team of professionals will then carry out the necessary due diligence checks.

You can read about this in our in-depth guide, but it essentially involves scrutinising your premises, finances, assets, liabilities, clientele and reputation, as well as external threats and competition.

Almost there… You have arrived at the final stage of selling your business! It’s time to seal the deal.

If no problems arise during due diligence, the buyer will be able to commit to a final, legally-binding ‘Purchase of Business Agreement’. This document will look like the ‘Heads of Terms’ or ‘Letters of Intent’ from the negotiation stage.

However, any if any problems are discovered during checks, this would usually lead to renegotiation, or as aforementioned, the buyer may drop out of the deal.

This is why we can’t emphasise enough the importance of being honest from the outset.

One more thing to get over the line…

You will need to obtain any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities. Once you have these, and the money has been transferred – you will have officially sold your business!

Congratulations!

Now you’ve completed, you must agree on a suitable handover.

This can be transitional or immediate…

We recommend a transitional handover where possible as it allows for a smoother transfer of ownership. The new owner will experience the running of the business as there will be an overlap period of a few weeks with the seller. This is extremely beneficial for the buyer to see how to business is currently run.

Or, you may opt for an immediate handover. In this case, after the sale is finalised, the seller has nothing more to do with the business.

There it is, your ultimate guide to selling an engineering & manufacturing business.

It may seem like hard work, but with a little preparation and planning, you can achieve the best possible sale price.

By selling with Intelligent, we will take away the stress of selling so that you can focus on your business instead.

Our dedicated expert team will work hard to fully understand your business and what makes it unique, giving you peace of mind.

Why not get a free, instant valuation of your business via the tool below?

Get a quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.