How to Sell an Agriculture, Horticulture & Marine Business

Do you own an agriculture, horticulture or marine business? Are you thinking of selling your business in the near future? Well, you’re in the right place.

Agriculture is the single largest employer in the world. In fact, farmland covers about 64% of the UK, with more than 20 million hectares of land (or 30 million football pitches!).

Additionally, horticulture and landscaping in the UK makes a contribution of approximately £24.2 billion to GDP every year. Responsible for around 568,700 jobs, or 1 in every 62, it’s no wonder this industry is one of the most popular amongst business buyers.

Whether you own a farm, garden centre, marine and boat company or forestry business, Intelligent can help you when it comes to selling. Keep reading for a step by step breakdown on how to sell your agriculture, horticulture and marine business, including; valuation advice, preparing your business for sale, negotiation tips, and finalising the deal.

To value your business, you will need to start by combining your business’ assets and its goodwill attributes.

The assets held by your business will differ depending on the kind of business you’re operating. Let’s take a look at a farming business, for example.

Typical assets within a farming business include:

For an accurate valuation, you should honestly assess the age and condition of your assets. Higher-quality assets can be more attractive to a buyer, they mean the buyer does not need to worry about replacing any key items soon.

Calculating the goodwill value of a business can be more difficult. To estimate your agriculture, horticulture & marine business’ goodwill value, it’s important to consider the following:

Naturally, a lot of business owners have an emotional attachment to their businesses, this means when trying to conduct a valuation it can be difficult to remove this bias. This is why we would always recommend seeking advice from a business broker if you’re looking to get a true and accurate valuation.

At Intelligent, we have a dedicated expert team with years of experience in calculating the value of hundreds of health & beauty businesses.

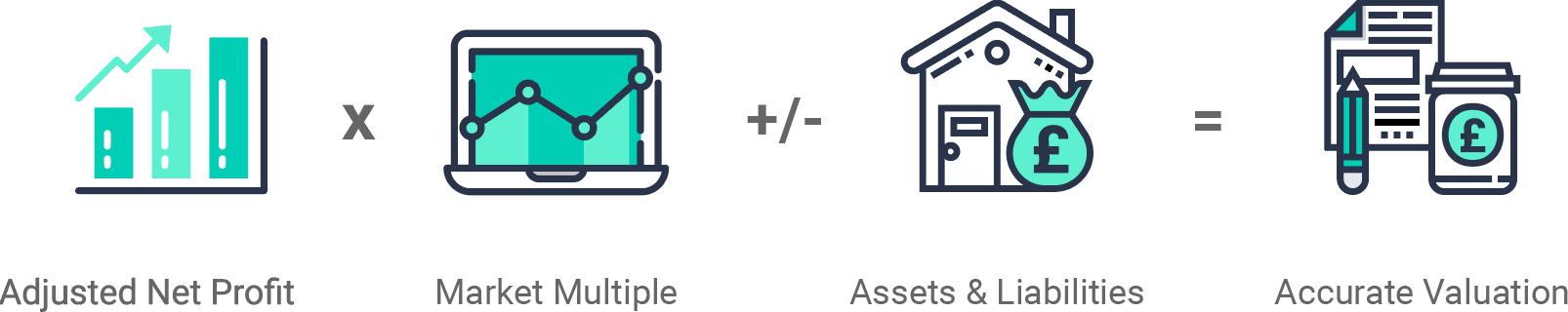

We use a tailored approach depending on the business’s characteristics but using the same basic formula as shown below:

Adjusted Net Profit

This calculation takes into consideration any exceptional costs that the business has incurred. These exceptional costs are not considered part of the normal course of business and should therefore be excluded

Market Multiple

We analyse buyer behaviour and transactions regionally and nationally. We overlay our experience, sector knowledge and understanding of market trends to provide a real time market multiple

Assets & Liabilities

An asset is something that the business owns and is a key factor in determining the businesses value. These include such things as property, stock and equipment. A liability is the opposite of an asset and includes things such as loans, tax and mortgages

The first step to preparing your business for sale is to start gathering all of the necessary information into one place. This will make you as prepared as possible for any questions a potential buyer may throw your way.

That’s not all…

Addressing any small, easily rectified issues with your business can help to make your business more attractive, driving the best possible price.

We’ve put together a list of key actions you should follow to make sure your business is ready for the open market.

One of the easiest ways to improve your business’ appeal it to carry out any immediate maintenance and repair. Carrying this work out before putting your business on the market will make it much more attractive to potential purchasers.

However, be sure not to go overboard.

Whilst a tidy appearance will improve your business’ appeal, it won’t necessarily impact its value. This means you should avoid undergoing a large, costly refurbishment or investing in brand new, expensive equipment just before your sale. Chances are you won’t regain this cost when you’ve sold.

Hygiene is often a top priority for potential buyers. It is crucial to ensure the highest standards to maintain buyer interest.

This is especially important in this close contact industry.

Fortunately, this is a remedy which is relatively simple and affordable to do.

When a buyer is enquiring on your business, one of the first things they will ask to see is likely to include your financial documents. We would always recommend having at least three years of financial statements prepared.

These will provide a buyer with an overview of your business’s financial health and stability, helping them to decide if it is a suitable choice for their needs.

The financial documents you will need are as follows:

When your buyer completes their due diligence, they will discover any falsehoods within your business’s finances, so ensure you’re as honest and accurate as possible.

Other important documents to have to hand include:

How would you describe your business’ operations? Are you an owner-operator, or do you have a management team in place to run things for you?

However you run your business, it’s important to try and prepare your business for every type of buyer. Outline your management structure clearly, perhaps asking your current managers and/or team leaders to take on more responsibilities on a day-to-day basis.

Once your potential buyer has shown an interest in your business (click here for a guide on how to manage queries), it’s time to begin the negotiation stage.

Discuss and agree with your buyer and acceptable purchase price, as well as what is to be included within the sale. Having all of your documents prepared in advance will ensure you’re be able to negotiate efficiently.

Of course, the buyer will be inquisitive but remember, this is a two-way process. You should also be assessing their potential and capacity to run a business successfully.

Once agreed, the elements will be written down in a document called ‘Heads of Terms’ or ‘Letters of Intent’ . This document will include your final sale price, the sale’s terms, and a thorough itinerary of everything included in the price.

For all intents and purposes, this is finalising the sale, although it is not legally binding just yet.

Just as with management structure, different buyers will be looking to finance their business sale differently. Some buyers may look to pay the full sale price in one lump sum, but others may wish to offer a higher amount but proceed with a payment plan. This is known as owner or seller financing.

To protect yourself from buyer default, it’s important that you work with a good solicitor. We can help with that!

Using an Intelligent trusted partner, you’ll save time and money. Sellers complete on average 4 weeks earlier than the industry standard and our negotiated savings are passed on in full.

Let’s see what’s next…

We’re nearly there, this is the last step to selling your business.

Your buyer and their legal team will now complete a process called due diligence. You can read all about this in our in-depth guide, but in a nutshell, it involves looking at your premises, finances, assets, liabilities, clientele and reputation under a microscope - as well as assessing any external threats and competition.

Any inconsistencies which may be uncovered during due diligence will most likely lead to the sale price having to be renegotiated. In a worst-case scenario, the buyer may drop out of the deal completely.

Whilst your buyer is working on this, you should start to obtain any necessary permissions from landlords and banks for the transfer of premises, equipment, and liabilities.

Once these have been completed, your buyer will be able to commit to a final, legally-binding ‘Purchase of Business Agreement’. When everything has been finalised and the money is transferred, you will have officially sold your business.

Congratulations!

One last thing, have you thought about a handover period?

There are two types of handover: immediate and transitional. An immediate handover is a sudden shift in ownership and management. This means the day to day running of the business will become the responsibility of the new owner as soon as the business changes hands.

Alternatively, you may decide to offer what is known as a transitional handover. This allows for a smoother exchange of ownership, where you would stay on board with the business for a short time to help your buyer become accustomed to their new business.

Where possible, we’d always recommend being open to a transitional handover – as it is often a more attractive proposition to buyers.

10 Steps to a Higher Valuation

Glossary of Business Sale Terms

There it is, our all-encompassing guide to selling an agriculture, horticulture & marine business.

It can certainly be hard work, but with preparation and planning, anyone can achieve the best possible price for their business.

Selling with Intelligent takes away the stress of selling, meaning you can focus on the continued running of your business instead.

Our dedicated expert team will work hard to fully understand your agriculture, horticulture and marine business and what makes it unique, giving you peace of mind.

Get quick and easy insight into the real value of your business, without any obligations.

At Intelligent, all of our experts use a specific formula that will give you a free and highly accurate baseline valuation so that you've got a figure to work with that most realistically resembles the value of your business.